The Thai baht has gone from being Asia’s top-performing currency in 2019 to dead last in January.

Finishing in the middle of the pack may be the best that can be expected this year as the central bank and a host of other forces line up against it.

The currency’s 9% surge in the 12 months through December was more than double that of its closest rival, the Philippine peso. It was also a threat to the nation’s economic competitiveness that rang alarm bells in Bangkok.

Bank of Thailand Governor Veerathai Santiprabhob put the market on notice in a recent interview that this year will be different. He plans to rein in the baht by easing curbs on foreign-currency deposits, letting exporters keep more of their proceeds overseas and allowing insurance companies to increase investment abroad.

The central bank isn’t the only thing that’s set to curb the currency.

Declining exports, low agricultural prices and a drop in international visitors loom as risks to growth over the next 12 to 18 months, according to Kobsak Pootrakool, secretary of the Council of Economic Ministers.

The outbreak of a new coronavirus in China may compound problems for the key tourism industry. Chinese travelers are the biggest foreign spenders in Thailand, accounting for about 30% of tourist receipts last year, according to government data through November.

A voting irregularity in parliament has delayed approval of the annual budget. This may harm economic growth if government expenditure is held back too long.

Meanwhile, deep political divisions could deter fund inflows from overseas, and widely reported plans for British supermarket chain Tesco Plc to sell its Thai operations have also whacked the currency.

Back in Range

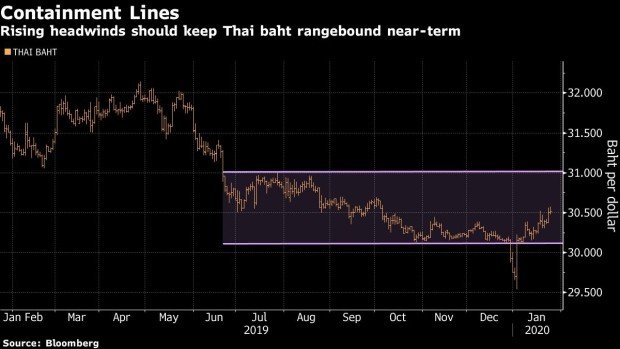

After briefly spiking to around 29.54 per dollar earlier this month, the baht has returned to its 30.00-31.00 range. Analysts surveyed by Bloomberg project it to reach 30.2 by the end of the year.

“We expect the baht to soften in the coming months — it is over-valued based on our models,” said Chang Wei Liang, a macro strategist at DBS Bank Ltd. in Singapore. “The government has also flagged concerns over the strong baht, putting a brake on gains.”

Even improving economies and the easing of trade tensions between the U.S. and China are weighing on the currency, which benefited as a haven last year.

Current Account

December balance of payments figures due this week are a bright spot. They are forecast to show another large current account surplus — a trend that is likely to continue in 2020, providing some support for the baht.

But the headwinds remain. Hopes of wearing Asia’s currency crown again will have to wait for another year.

Below are the region’s key economic data and events due this week:

- Tuesday, Jan. 28: Australia NAB business confidence, Japan PPI services

- Wednesday, Jan. 29: Australia 4Q CPI, Bank of Japan summary of opinions, South Korea consumer confidence

- Thursday, Jan. 30: New Zealand trade balance, BOJ’s Amamiya speaks, South Korea manufacturing and non-manufacturing business surveys

- Friday, Jan. 31: China manufacturing and non-manufacturing PMI’s, Australia 4Q PPI, New Zealand consumer confidence, Tokyo CPI and Japan jobless rate, industrial production, retail sales, South Korea industrial production, Thailand BoP current account and trade balances, India 2019 GDP annual est.

–With assistance from Siraphob Thanthong-Knight, Chester Yung and Yumi Teso.