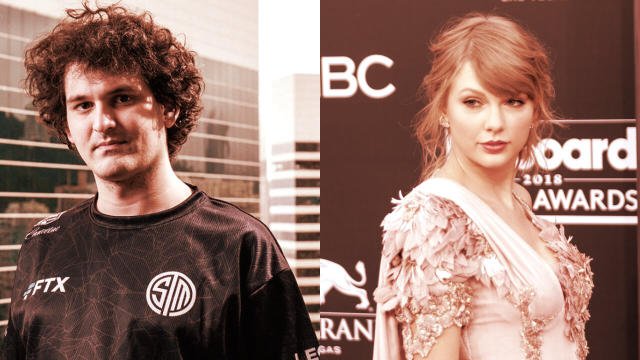

Former FTX CEO Sam Bankman-Fried flew to New York from the Bahamas to face fraud allegations.

The 30-year-old was extradited for “one of the largest financial crimes in US history,” according to US investigators.

Mr. Bankman-Fried, who rejects the charges, may appear in court later Thursday morning.

Two former associates pled guilty to related offenses.

“Roles in the frauds that lead to FTX’s collapse” were charged against FTX co-founder Gary Wang and former Alameda Research CEO Caroline Ellison, according to Southern District of New York attorney Damian Williams.

In a video published with court records, he stated they are now cooperating with the Southern District of New York.

Mr. Wang’s counsel said he took his witness duties seriously and accepted responsibility for his acts.

Mr. Williams said Samuel Bankman-Fried is in FBI custody and returning to the US. He will be taken directly to the Southern District of New York and brought before a judge there as soon as feasible.

“Get ahead of it if you participated in misbehavior at FTX or Alameda,” he said. “We move fast and our patience is limited.”

The SEC charged Ms Ellison and Mr Wang separately (SEC).

“Orchestrating a plot to defraud equity investors in FTX,” Mr. Bankman-Fried was charged last week. The SEC called the previous “King of Crypto” a “house of cards on a foundation of fraud”.

“As alleged, Mr. Bankman-Fried, Ms. Ellison, and Mr. Wang were active participants in a scheme to conceal material information from FTX investors, including through their efforts to artificially prop up the value of FTX, which served as collateral for undisclosed loans that Alameda took out from FTX pursuant to its undisclosed, and virtually unlimited, line of credit,” said Sanjay Wadhwa, deputy director of the SEC’s Division of Enforcement.

“Defendants concealed FTX’s investors and customers’ very real dangers by secretly siphoning customer monies onto Alameda’s books.”

Many FTX customers cannot withdraw monies due to bankruptcy.

In a court filing, FTX owed its 50 largest creditors over $3.1bn (£2.5bn).

Mr. Bankman-Fried is accused of using customer monies to boost up Alameda.

US calls FTX fraud “one of biggest” in history.

Bahamas arrests FTX founder Sam Bankman-Fried.

Sam Bankman-fall Fried’s

Last Thursday, Mr. Williams accused Mr. Bankman-Fried of one of the greatest US scams.

Mr. Williams also accused the FTX founder of illegally donating “tens of millions” to Democrats and Republicans.

.Before his detention, Mr. Bankman-Fried told BBC News: “Fraud wasn’t intentional. I didn’t cheat. No way. I was really less skilled than I expected.” Mr. Bankman-Fried also denies knowing Alameda used FTX customer funds.

Customers could exchange cash for Bitcoin on the FTX exchange.

Cryptocurrencies are held online and behave like investment vehicles or securities, frequently with considerable volatility.

FTX had 1.2 million registered users, but many are worried if they will ever get their cash back from FTX’s digital wallets.

Mr. Bankman-Fried, a young Warren Buffett, had a net worth of over $15bn as of late October.