The values of Bitcoin (BTC) and Ethereum (ETH) have been steadily rising, remaining above $23,000 and $1,500, respectively, on the market. The worldwide crypto market cap has increased overall as a result, reaching $1.05 trillion today, a gain of 0.91% over the previous day.

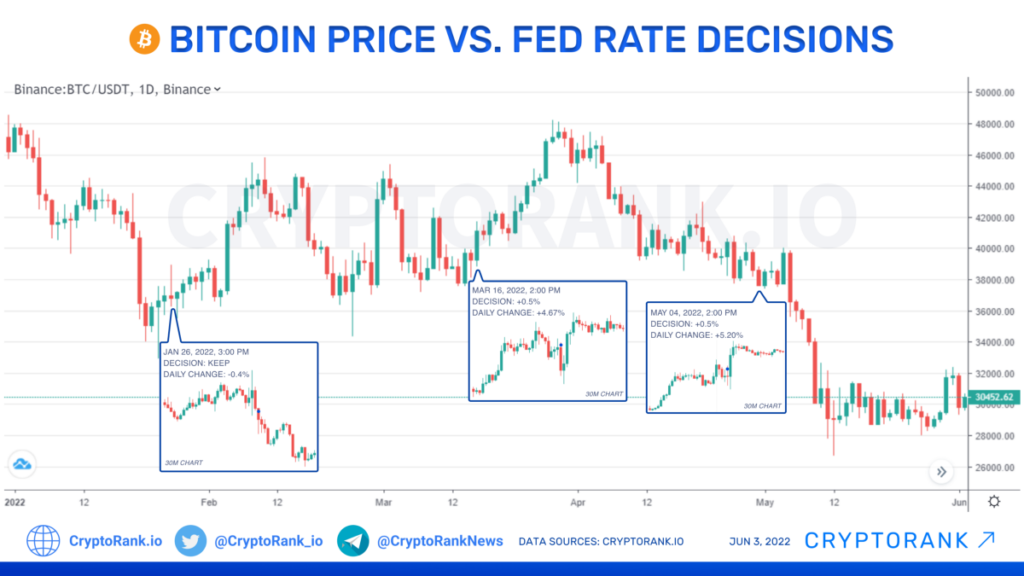

Despite this, traders don’t seem eager to make any substantial offers before the US Federal Reserve makes its statement. In addition to discussing the present US Federal Open Market Committee (FOMC) and Fed rate, this post will concentrate on forecasting Bitcoin values and Ethereum prices.

The cryptocurrency markets have been steady and flashing green since the start of this year, which may be ascribed to the Federal Reserve’s conceivably dovish posture.

Along with the imminent Federal Reserve interest rate hike, an agreement announced by DekaBank and Metaco to start supplying digital assets to institutions will have a big influence on the crypto market

:FOMC and Fed Fund Rate

The US dollar initially declined during the trading session as a result of information that suggested wage pressures had subsided, but it later stabilized as investors awaited the outcome of a Federal Reserve policy meeting.

On Wednesday, the US Federal Reserve is expected to raise interest rates by 0.25%; but, traders will pay closer attention to Chairman Jerome Powell’s press conference for hints about the Fed’s long-term outlook for policy change.

However, the dollar index, which compares the dollar to six other major currencies, fell 0.029% to 102.060. The announcement that US labor costs increased at the slowest rate in a year during the fourth quarter contributed to the market’s 0.16% decline in the previous trading session.

Investors will be closely monitoring the choices made this week by the Bank of England and the European Central Bank. On Thursday, both are expected to increase interest rates by 0.5%, so investors should make sure they keep track of these economic developments.

Continual US dollar depreciation was also seen to be a key factor in maintaining high cryptocurrency values.

A European Bank Will Offer Crypto Services

DekaBank has committed to work with Metaco to start selling digital assets to institutions. DekaBank is a 105-year-old bank with $428 billion in assets. DekaBank will utilize Metaco’s Harmonize, a platform for “custody and orchestration,” according to a press release from January 31.

Since the custodial platform is crucial to DekaBank, its announcement had a significant effect on the cryptocurrency market, especially Bitcoin. This platform will allow Metaco to keep tabs on all operations involving digital assets, which is why the announcement was so important.

The Recent Risk-On Wave In Crypto Markets: An Explanation

Due to the fact that $117 million, the greatest sum since July of last year, was invested in crypto-based investment products between January 21 and 27, the global cryptocurrency market has maintained its bullish trend and increased bids around the $1.05 trillion barrier.

The good news about bitcoin rules also significantly affected the mood of the cryptocurrency market. Investors seem hesitant to make a significant bid at this time until the Federal Reserve policy meeting is through.

Bitcoin Cost

The price of one bitcoin is at $22,993.90, and there was $22 billion worth of transactions yesterday. It now ranks first on CoinMarketCap with a market valuation of $443 billion after rising by 0.25% over the last 24 hours.

As the market waits for the Federal Open Market Committee and Federal Reserve to announce their rate choices, Bitcoin is trading on the 4-hour time frame without any obvious bias. However, the $23,300 level continues to act as the pair’s immediate obstacle. If this level is broken, the BTC/USD pair may then move on to the next resistance zone of $23,920.

The 50-day simple moving average also points to a selling trend, and leading technical indicators like the RSI and MACD are in a sell zone.

A bearish breakout of this level might open up further selling space till $22,350. On the downside, an upward trendline is likely to support Bitcoin at $22,750.

Ethereum Cost

Today’s price of Ethereum is $1,572.48 and the past 24 hours’ trading volume was $6.2 billion. Since then, its value has dropped by 0.03%, and it presently maintains rank 2 on CoinMarketCap with a market worth of $192 billion.

Once it reaches the double-bottom support level of $1,540, according to technical research, Ethereum could enjoy a positive reversal. On the upside, obstacles still exist because of strong resistance near the $1,600 level. If it gets past this barrier, ETH might go as high as $1,625.

If the $1,540 level of support fails to hold, it might lead to a further drop in price all the way to the $1,500 level.