Foreigners in Thailand are increasingly anxious about new income tax regulations, set to take effect from January 1, 2024. The Thai government aims to boost revenue by collecting an additional 100 billion baht through taxing assessable foreign income of tax residents. This includes both Thai nationals and foreigners residing in Thailand for six months or more annually. However, the clarity and implications of these tax changes have left many expatriates bewildered.

Retirees in places like Pattaya, in an informal survey, have expressed confusion over what constitutes assessable income, including whether pensions already taxed in their home countries are subject to additional taxation in Thailand. Questions abound about the impact on financial transfers, the complexities of double taxation treaties, and the necessity of obtaining a Thai tax identification number for visa renewals.

The uncertainty has led to discussions among expats about reducing their time in Thailand to avoid becoming tax residents. Many retirees, living on pensions already taxed abroad, are wary of engaging with Thai tax authorities and the associated costs of compliance. Misinformation on social media has further fueled anxiety, with claims circulating about Thai banks deducting tax from international transfers.

Concerns extend beyond individual finances to broader economic impacts, such as the future of Thailand’s expat market, particularly affecting retirees and foreign property investments. Amidst these uncertainties, accountancy firms are inundated with expatriates seeking guidance and updates on the evolving tax landscape.

While official clarification is anticipated, the lack of clear guidance from Thai authorities has compounded expat unease. Clarity on exemptions for certain visa holders, like retirees and spouses, and assurances against double taxation would alleviate some concerns. As Thailand navigates these tax reforms, expatriates await concrete assurances to navigate these changes effectively and sustainably.

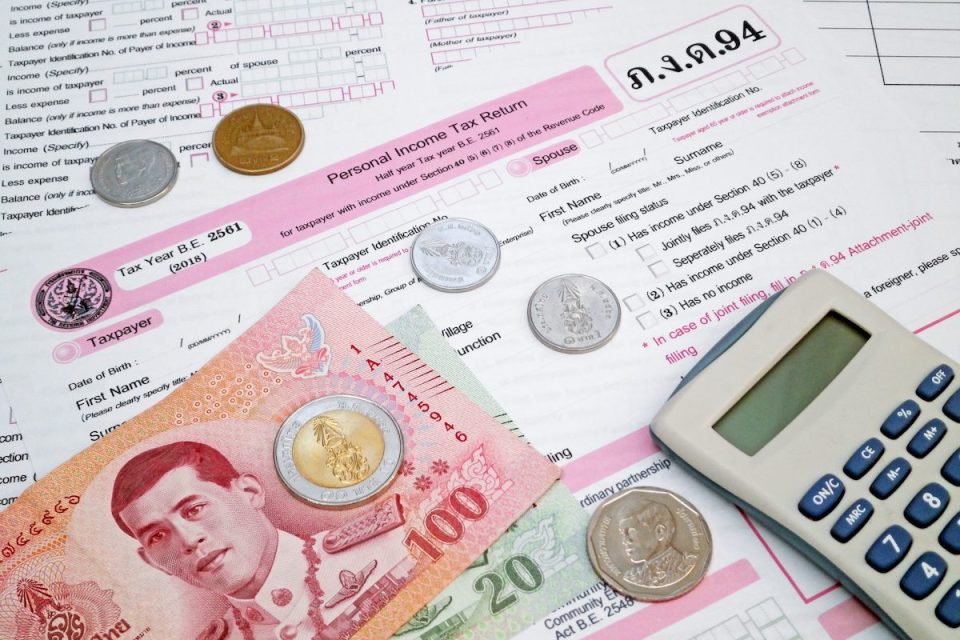

Credit: Pattaya Mail