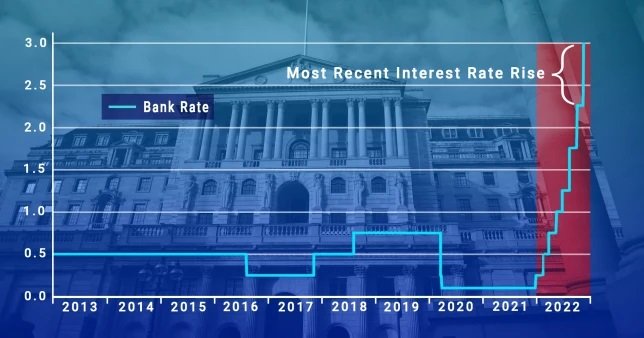

Homeowners face crippling mortgage costs after the Bank of England unveiled the biggest interest rate rise in more than 30 years.

The Bank’s base rate will rise to 3% from 2.25%, its highest the 2008 financial crisis, and decision makers warned further hikes are likely to rein in runaway inflation.

It will help pile around £3,000 per year on to bills for those households that are set to renew their mortgages, the Bank said.

Borrowers with a £200,000 standard variable mortgage could see their repayments rise by more than £1,000 a year.

Bank of England governor Andrew Bailey warned it was a ‘tough road ahead’ for the UK and households.

He acknowledged that eight rate rises since last December are ‘big changes and they have a real impact on peoples’ lives’.

But he said: ‘If we do not act forcefully now, it would be worse later on.’

However, he added: ‘We think Bank rate will have to go up by less than is currently priced in by financial markets.’

This means that ‘fixed rate mortgages should not need to rise as much as they have done’.

Sir Keir Starmer said the jump will make people’s financial positions ‘much, much harder’.

The Labour leader blamed 12 years of Conservative government for leaving the nation more exposed because of a lack of growth, saying mortgage-payers know they are paying a ‘Tory premium’.

The Bank also warned that the UK could be on course for the longest recession since reliable records began 100 years ago.

The economy could fall into eight consecutive quarters of negative growth if current market expectations prove correct. It would be the longest period of uninterrupted decline that the nation has experienced for around a century.

However, it would be a milder recession than in previous times.

The huge hike and dire warning saw the pound fall 1.4% to 1.123 against the US dollar and 0.8% to 1.15 euros.

Meanwhile, unemployment is expected to peak at around 6.5%, from 3.5% today, slightly lower than in 2008.

There was better news in the Bank’s inflation projection.

It had previously forecast inflation to peak at 13% in the third quarter of this year, but with the Government’s support on household energy bills the forecast was slashed to 10.9%.

The Government has said that the energy support – which currently caps bills at 34p per unit of electricity and 10.3p per unit of gas – will be reviewed next April, instead of running for two years as previously promised.

Assuming that some support will remain in place for the full two years – albeit half as generous from April next year – the Bank forecast that inflation would drop to 5.25% next year before dropping to 1.5% in 2024.