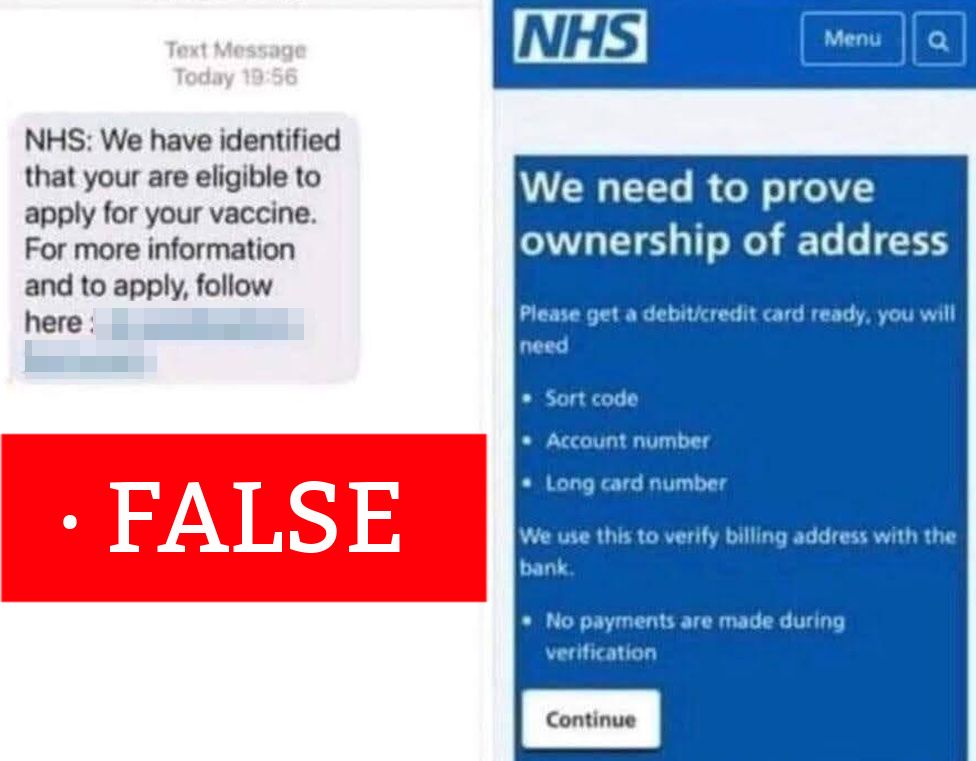

Fraudsters are sending out bogus text messages about the coronavirus vaccine in an attempt to steal bank details.

The scam tells recipients they are “eligible to apply for your vaccine” with a link to a bogus NHS website, trading standards officers have warned.

That, in turn, asks for personal information and – crucially – bank details “for verification”.

The warning comes the same day as MPs heard that Covid is leading some people into the net of pension fraudsters.

The fake NHS message is one of a range of scams which have sought to take advantage of the pandemic and the isolation and legitimate worries of potential victims, according to the Chartered Trading Standards Institute.

Others have included people travelling door-to-door selling counterfeit or useless protection equipment, or fraudsters claiming to be from the official test and trace service and demanding payments.

The latest scam is preying on those elderly or vulnerable people who are fully expecting to receive legitimate information about their vaccine.

Health authorities have stressed they would never ask for an individual’s banking details.

Katherine Hart, lead office at the CTSI, said: “I have been tracking and warning the public about Covid-related scams since the beginning of the pandemic, and at every stage of response, unscrupulous individuals have modified their campaigns to defraud the public.

“The vaccine brings great hope for an end to the pandemic and lockdowns, but some only wish to create even further misery by defrauding others. The NHS will never ask you for banking details, passwords, or PIN numbers and these should serve as instant red flags.”

The warning came as MPs on the Work and Pensions Select Committee heard how fraudsters were seizing on victims’ financial uncertainty during the pandemic to draw them into pension scams.

Rules allowing people to withdraw cash from their pension pot from the age of 55 have led some people to move money into investment schemes which look generous, but are simply vehicles to steal money.

“Household finances are stretched and so the temptations to use savings or to be tempted by offers of ‘free pension reviews’, for example, which we’ve warned about, are very real,” Mark Steward, from the Financial Conduct Authority told the committee.

“Of course, a ‘free pension review’ is hardly free. It is the first step on a process that will lead someone to investing in something that is too good to be true.”

Social media misuse

He said that fraudsters had used social media advertising to “industrialise” this kind of fraud.

Whereas previously, fraudsters had to produce sophisticated glossy brochures and office fronts, they could now operate in anonymity on social media, sending fake information to millions of people.

Millions of pounds have been lost to pension scams in recent years, but it is a crime considered to be widely under-reported by victims and pension companies.

Graeme Biggar, director general of the National Economic Crime Centre, told the committee that fraudsters were continuing to use new avenues to reach potential victims.

“What we’re looking to do next is to move on to fake comparison websites, which is this new gateway into investment frauds, to spot those and take them down at source,” he said.

bbc nsa