As well as safe investments, a balanced investment portfolio should include “alternative investments”. These are often higher-risk (but potentially higher-reward) investments include hedge funds, crowd funding, art, crypto currencies, private equity, and venture capital.

But one group of alternative investments that has both a real-world utility and, compared to others, comparatively low risk, is real estate – or property

Property investments tend to be considered more “slow and stable” mainly because apartments and office blocks aren’t directly traded on any exchanges (even if big property-owning companies can be). This helps protect real estate from daily swings in value. UK commercial real estate (i.e. offices and shops) saw total returns of 6% in 2018 and UK residential real estate (i.e. houses and apartments) returned around 3% – although there were regional variations, naturally.

Why invest in property?

As the owner of a property, you stand to benefit from any rise in its value when it comes to selling, from the income it can generate if you rent to tenants – and, of course, from the utility you get from living in or using it yourself negating the liability of rent payments which are at an all time high.

Real estate ownership is culturally dependent, the attractiveness of property ownership In the UK, for example, is traditionally desired: as in “an Englishman’s home is his castle”. But in other European countries like France and Germany, the idea of someone not owning any real estate isn’t unusual at all.

What about real estate stocks?

Yes you may of heard of these vehicles, maybe watch the ‘The Big Short’ to get an idea of how it can be so risky it really needs to be regulated, buying shares in companies which own properties and act as landlords, generating income in the form of rent. Because they’re listed companies, of course, the values of their stocks are subject to daily swings, sometimes these stocks can cause a global recession. So take advice!!

Some of the more established companies are “asset-backed” – i.e. they own real estate which investors can see and touch, which has a relatively stable value – and which the company can sell if it needs additional cash. That means their investors should be less likely to take flight in times of market turbulence than if they were backing, say, some dot com companies whose assets aren’t as tangible (how do you touch a website?).

In an economic downturn, however, it’s worth remembering that property prices may fall as well as stocks’ – potentially hitting you hard, so you need to be active to make sure you are in touch, or have an IFA that you know well and does well.

How has real estate performed as an investment?

It’s no secret that the value of land and, by extension, property in the UK has increased over time. Islands like the UK have limited space, after all and more people wanting to live there mean more demand for the same supply. But just how has that affected prices?

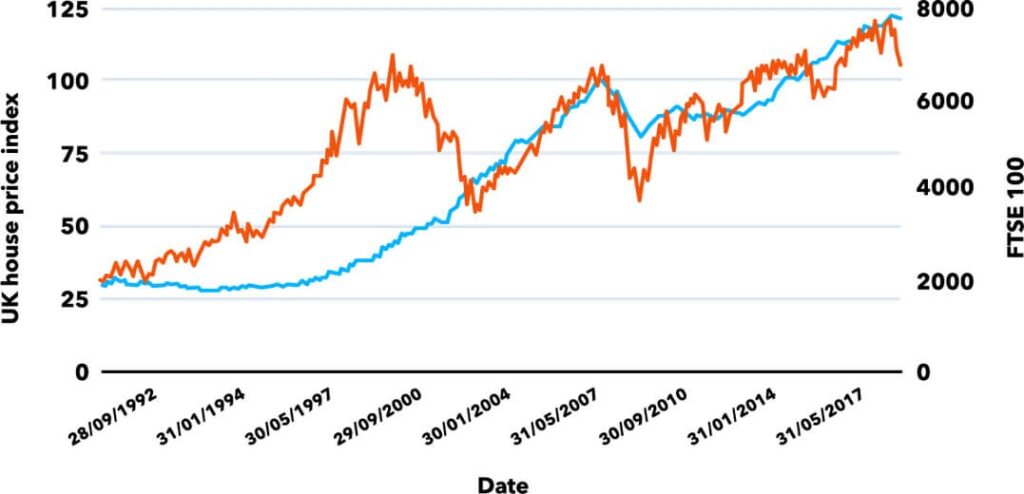

UK property prices have performed better than the UK stock market since 1989

It depends on your frame of reference. But if you begin in 1989; UK house prices have risen 308% – while the UK stock market has only risen 228%.

Time, patience and knowledge being your frugal partner you will have seen significant dips in the value of both. For example, starting your measurement in 2000 (just after the burst of the tech dotcom bubble) would make house prices the clear outperformer whereas the returns from buying a house in 2008 would have been outshone by stocks’ come 2014.

Note that in the above chart, we haven’t included income some property owners would’ve generated from renting out their properties. But to make it fair, we’ve also only shown the change in price of FTSE 100 stocks – and not included the additional return investors would’ve received from dividends

If you needed any more evidence that it’s all about timing, look no further than analysis from investment bank Credit Suisse. By one measure, investing in the UK stock market in 1900 would’ve averaged an annual 5.5% return over the subsequent 118 years, compared to property’s 1.8%.

Investing isn’t a hard science like chemistry, where the same experiment under the same conditions leads to the same result every time. However, there are some basic axioms, mainly centered on age with risk, for which investors can rely. Understanding and creating a portfolio allocation using stocks, bonds, and cash that aligns with your risk tolerances and short-term versus long-term needs is important, to begin with.

Expat Advice Asia

Assisting expats in getting best advice in the marketplace

Our services include:

• Investments

• Insurance

• Pensions

• Mortgages

• Offshore Banking

• Wills & Estate Planning